What is the process of buying securities via truCrowd?

Anyone can see the offering, but to be able to Invest (and comment on the Q&A section) an investor has to open an account on truCrowd.

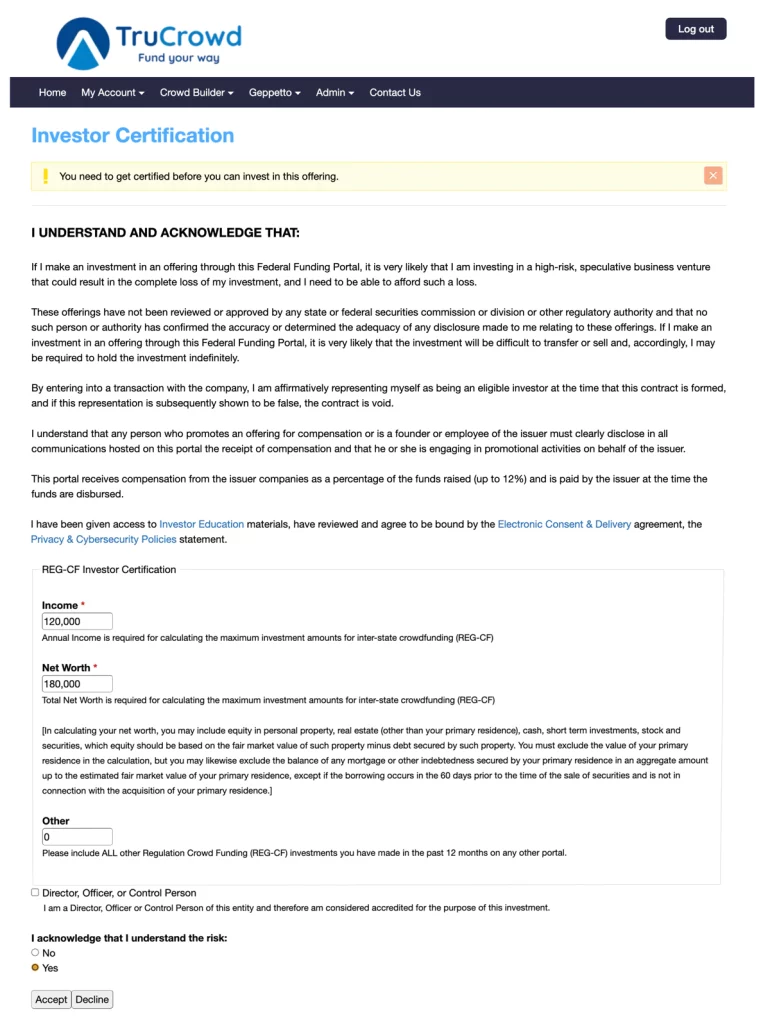

Part of setting the account, the investors will be asked to self-certify their annual income, net worth for the year and investments made via Reg CF (other portals) outside truCrowd. We will use those numbers to calculate the investor’s investing limit.

After finding an Offering that she or he might want to invest, the investor has to provide bank info (if she or he chooses to use ACH method of payment) and her/his address.

Next, the investor will choose the amount of securities she or he wants to purchase,

Then, the investor must confirm the disclosures (also, provided on the screen – example below) and click the Invest button.

Next, the investor will get an email to confirm her/his investment commitment.

If the investor wants to send the funds (to the escrow agent) via ACH, then, the last step is to Confirm the investment (after the investor’s account is fully completed), otherwise, after the investment is confirmed, the investors has to mail a check or initiate a wire transfer, according with the method of payment they chose.

After the issuer has reached in target amount and there is a closing, the investors will get her/his securities via a Stock Transfer Agent.

-

What are risks and how can I avoid them?5

-

Ownership, ROI & follow-up7

-

What are the Risks?3

-

Why truCrowd6

-

Learn Crowdfunding9

-

Learn truCrowd9

-

Prepare your Regulation CrowdFunding campaign8

-

During your Regulation CrowdFunding campaign7

-

Investing with truCrowd10

-

Revenue Participation Financing: An Introduction4